What happens to NFTs now?

-

April 08, 2023

Trends

Written by Tang Kai Xian/Steven Shannon

The genesis of the non-fungible token (NFT) market can be traced back to 2014 when Kevin McCoy minted "Quantum" on Namecoin, which subsequently fetched US$1.47 million at Sotheby's auction in 2021. Spells of Genesis and Pepe were released in 2015 and 2016 respectively. That was when NFT was still in its formative stages. It was not until the Covid-19 pandemic, when people increasingly connected online, that NFTs gained widespread mainstream attention. Other notable factors contributing to NFT's meteoric rise include the launch of NBA Top Shot and Beeple's remarkable US$69.3 million NFT sale. With the world gradually transitioning into a post-pandemic era, what has become of NFTs?

NFTs Explained.

Source: Pixabay

NFTs, or non-fungible tokens, are uniquely identifiable tokens used to certify ownership and authenticity. Non-fungible refers to something that is unique and cannot be replaced. By contrast, physical money and cryptocurrencies are fungible, which means they can be traded or exchanged for one another. Each NFT contains a unique digital signature and a reference to a separate asset, and the owner of the NFT now owns the separate asset. One common use of NFTs is to transfer digital art.

NFTs rely on the blockchain network to establish ownership and guarantee its authenticity. At its core, blockchain is a decentralised, immutable ledger that enables secure transaction recording and tracking of assets across a distributed network. An asset can be tangible or intangible. Anything of value can be tracked and traded on a blockchain network. By leveraging a blockchain explorer, anyone can seamlessly access shared real-time data stored on an immutable ledger that is accessible only to authorised members. Its transparency and the fact that all members share a single view of the truth lend confidence to the validity and accuracy of the information at hand.

NFT marketplaces are blockchain platforms where one can store, sell and mint/create NFTs. Popular sites include OpenSea, Rarible, NBA Top Shot, Nifty Gateway and SuperRare.

Why the NFT craze?

Jack Dorsey's very first tweet NFT. Available at https://opensea.io/

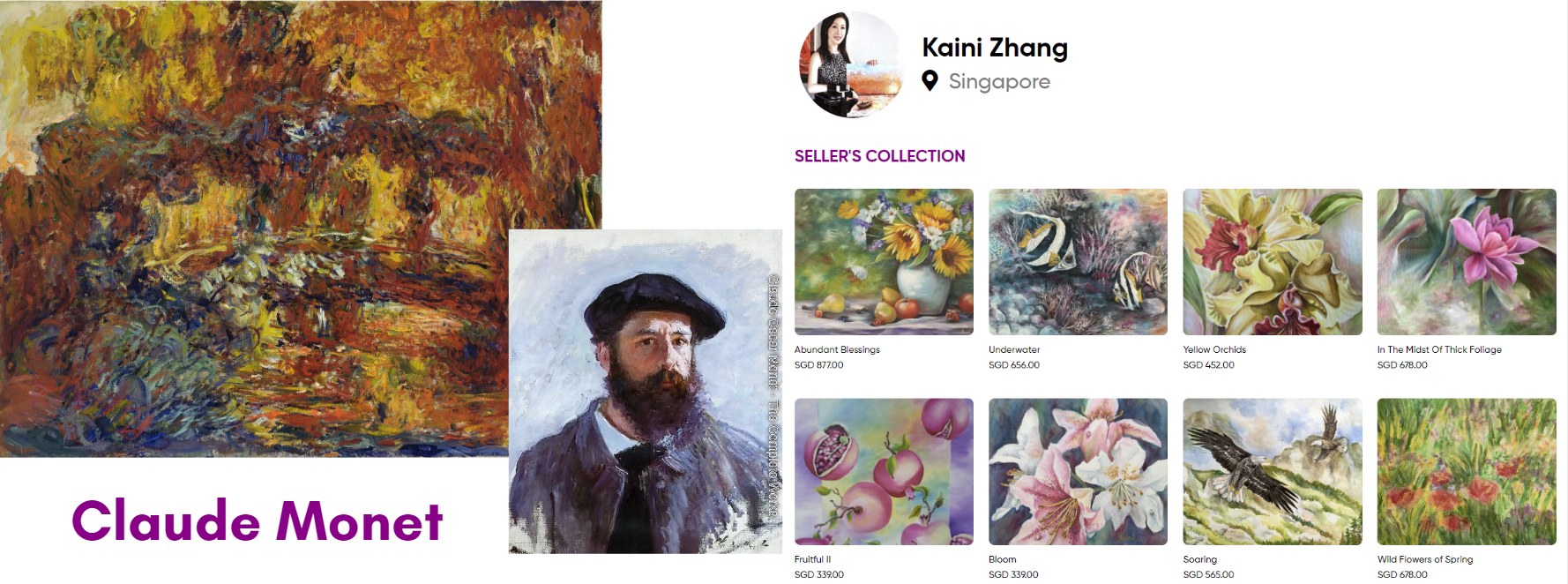

As per a survey conducted by DEXterlab, a majority of NFT buyers (64.3%) cited "To make money" as their primary motivation. Common ways of making money from NFTs are creating and selling, trading, and participating in NFT gaming. The value of an NFT depends on several factors, including its rarity and the level of speculation surrounding it. NFTs can be deemed valuable if they are one-of-a-kind creations from esteemed artists or famous individuals. For instance, in 2021, Jack Dorsey, the then CEO of Twitter, sold a tokenized representation of his very first tweet for over US$2.9 million.

Another reason for buying NFTs is to participate in NFT communities, where owning a token serves as a form of membership. An example is the Bored Ape Yacht Club. NFT communities are groups of individuals who share a common interest in a specific NFT project. These communities allow members to interact, share ideas, and discuss matters related to the project. Membership benefits include access to exclusive Discord servers, opportunities for collaboration, and participation in community events. For instance, ARC, an NFT community co-founded by JJ Lin, held a lavish private party in late 2022 at the prestigious Fullerton Bay Hotel in Singapore. The event was graced by local and international celebrities such as Taiwanese actor Chen Bolin.

NFTs have also become a popular medium for digital art collectors. Unlike physical art pieces, NFT art is readily accessible on online NFT marketplaces. The confidence in NFTs is bolstered by the blockchain technology attached to the NFT that represents proof of ownership. Many believe that NFTs represent the future of art collecting in the context of a rapidly digitalizing world and the emergence of Web 3.0. Before the crypto winter, Art Basel surveyed high-net-worth (HNW) collectors and found that they spent an average of US$46,000 on art-based NFTs, which was a significant increase from US$44,000 in 2021 and US$35,000 in 2020. In response to this trend, some art galleries have shifted their focus towards NFTs. For example, Pace Gallery has launched Pace Verso, an NFT platform for the minting, collecting, and exhibiting of NFTs.

What happened to the NFT art market?

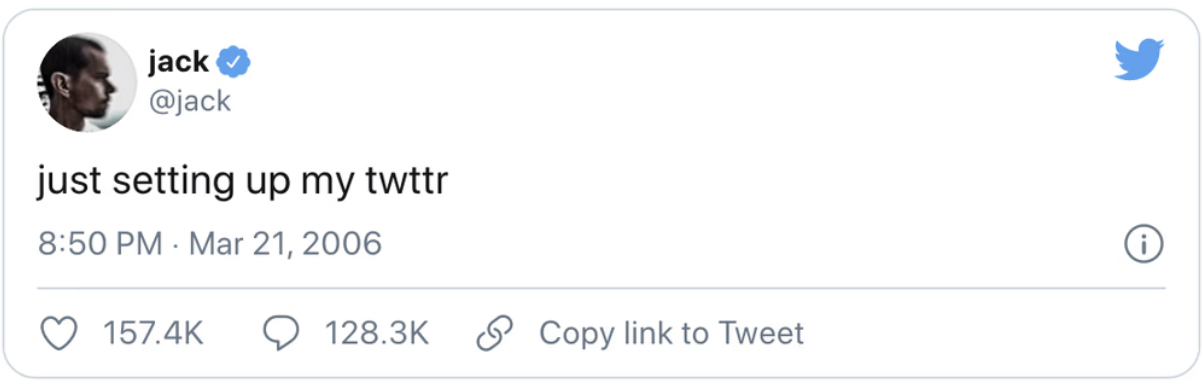

Overall NFT art Market:

Source: The Art Basel and UBS Global Art Market Report 2023

NFT sales in 2021 started strong, carried by the momentum of the previous year. A standout moment in 2021 was the landmark sale of Beeple's Everydays: The First 5000 Days at a Christie's auction, fetching an impressive US$69.3 million.

But the momentum did not last. After January 2022, the NFT market experienced declining sales volume and prices with a 97% decline in trading volume according to Bloomberg.

In spite of its deep contraction, the overall NFT market generated around US$24.7 billion worth of organic trading volume in 2022. This is a slight drop from the US$25.1 billion in 2021.

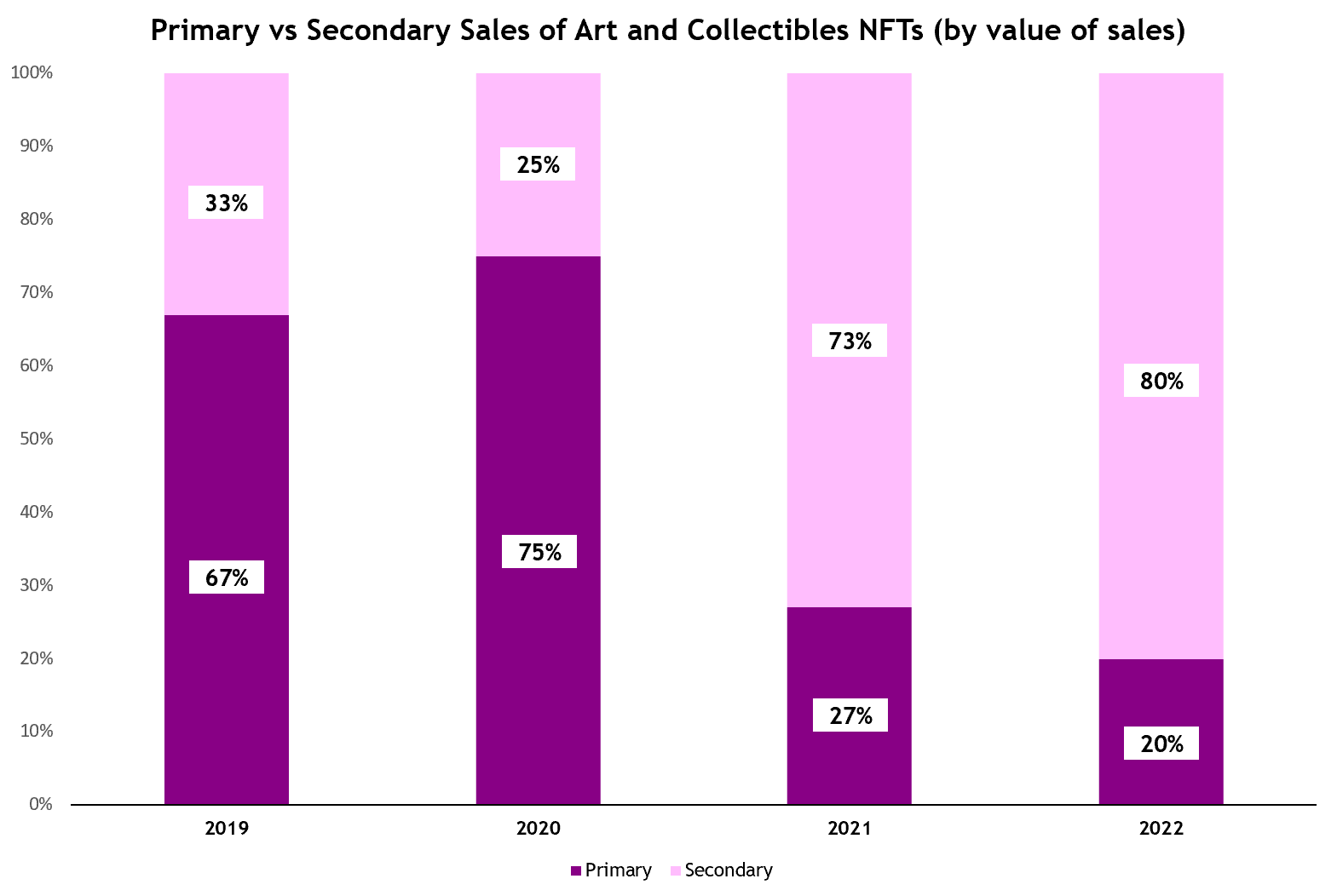

Proportion of Primary vs Secondary sales:

Data Source: The Art Basel and UBS Global Art Market Report 2023

Primary sales represent the first time an NFT is sold. This can be a purchase from the NFT artist or that NFT is minted on purchase. On the other hand, Secondary sales refers to NFT resales. The increased proportion of Secondary Sales with respect to Primary Sales reflects a shift from creation/new launches to reselling as the dominant activity on NFT marketplaces. The proportion of secondary sales accounts for a much larger share in 2022 than in 2021.

Contributing factors for the NFT market slump in 2022

1.Rising Interest Rates

Source: Unsplash

Since the onset of the Covid-19 pandemic, numerous countries, including the United States, have had to contend with heightened inflation. This upward trend in US inflation has persisted since May 2020, propelled by various factors, including robust household demand and supply chain deficiencies resulting from the pandemic. In June 2022, the USA recorded its largest increase in inflation in 40 years at 9.1%. To curb inflation, the US Federal Reserve, along with other central banks worldwide, have raised interest rates. Increased interest rates encourage saving and makes borrowing more expensive. Consequently, the appeal of riskier assets, such as cryptocurrencies and NFTs, dwindled.

2. Domino crash of cryptocurrency firms

Source: Pixabay

Cryptocurrency firms that crashed include Terra’s UST Stablecoin, Three Arrows Capital, Voyager, Celsius, and FTX. Since most buyers use cryptocurrency to buy NFTs, the downfall of cryptocurrency’s value decreased the value of NFT. Moreover, fewer people could afford to buy NFTs. Hence, the NFT trading volume was depressed.

Will the NFT market recover?

Despite the current bleak NFT market conditions and the loss of investor confidence, here are some important trends that could help the NFT market recover.

1. Big brands’ foray into NFTs

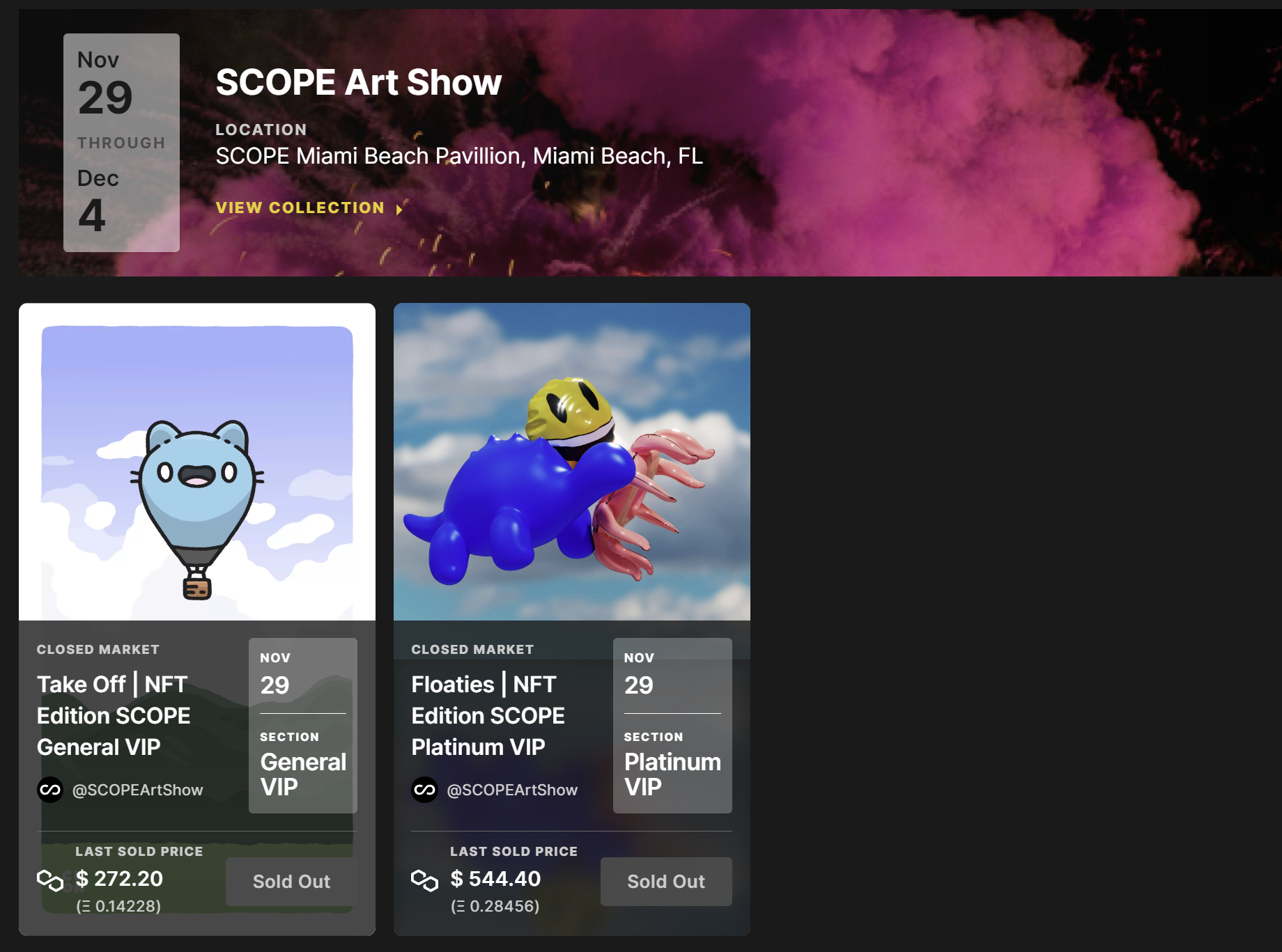

Source: Nifty Gateway

Well-known brands have started exploring use of NFTs to increase its reach and build a community in Web 3. A non-exhaustive list of brands that have or are currently exploring NFTs include Lamborghini, Coca-Cola, Nike, etc.

Starbucks is trialling its new blockchain-based loyalty program and NFT community, Starbucks Odyssey. Users can earn collectible Journey Stamps, aka NFTs. One way to earn is through interactive activities called ‘Journeys’. Journeys promote the Starbucks brand through gamified means such as playing puzzles. On 9 March, Starbucks released 2,000 digital “stamps” priced at $100 each. CoinDesk reported that the stamps sold out in 18 minutes and secondary sales rose. As of 5 April, The Starbucks Siren Collection #1 stamp’s floor price is US$475 on Nifty Gateway.

2. Wider use of NFTs

Source: YellowHeart

Apart from digital art, one use of NFTs that could become more mainstream is NFT Ticketing. NFT tickets are digital assets that hold one’s access credentials to an event. Given that NFTs are registered on a blockchain, the tickets can act as verifiable proof since the NFT cannot be duplicated. From an event organiser’s perspective, they can benefit from greater control over secondary ticketing sales. It is common for resellers in the secondary ticket market to inflate prices. NFT tickets, with the use of a smart contract, can be used to limit resale value. In late 2022, Scope Art Show Miami partnered with Yellow Heart, a Web 3 ticketing provider, to release exclusive NFT tickets animated by acclaimed creators in the metaverse, Mason Rothschild and Cool Cats. Platinum and VIP NFT tickets even give ticket holders early access to the event.

Closing Thoughts

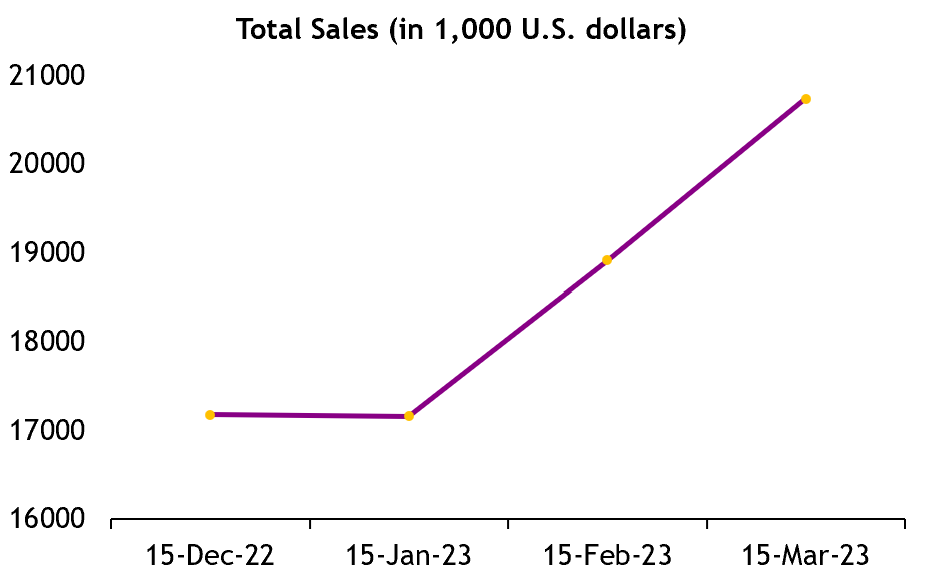

Sales in the NFT market have been positive in 2023 so far. Sales have increased for 3 consecutive periods: US$17 billion in mid-January, US$19 billion in mid-February and US$21 billion in mid-March. It should be noted that the resurgence in sales in February and March could be largely attributed to the rising NFT platform, Blur.

In spite of the volatility of the NFT market, NFTs are here to stay through the limitless applications of NFTs beyond pixelated art and play-to-earn blockchain games.

References:

https://d2u3kfwd92fzu7.cloudfront.net/Art%20Market%202022.pdf

https://www.ibm.com/sg-en/topics/what-is-blockchain

https://finance.yahoo.com/news/nft-sales-2022-nearly-matched-231149675.html

https://cointelegraph.com/news/how-do-you-assess-the-value-of-an-nft

https://www.pacegallery.com/pace-verso/

https://www.artbasel.com/stories/art-market-report-2022-collectors-cryptocurrency-nfts?lang=en

https://dexterlab.com/why-people-buy-nfts-dexterlab-survey/

https://vulcanpost.com/805105/nft-community-arc-star-studded-private-party/

https://tradingeconomics.com/united-states/inflation-cpi

https://phemex.com/academy/crypto-crash-2022

https://sg.news.yahoo.com/how-crypto-fell-2022-eight-charts-story-of-cruel-crash-060058350.html

https://www.binance.com/en/blog/nft/what-is-nft-ticketing-and-how-does-it-work-421499824684904022

https://oceandrive.com/yellowheart-scope-nft

https://decrypt.co/125444/nft-sales-near-2-billion-march-blur

PREVIOUS ARTICLE

PREVIOUS ARTICLE